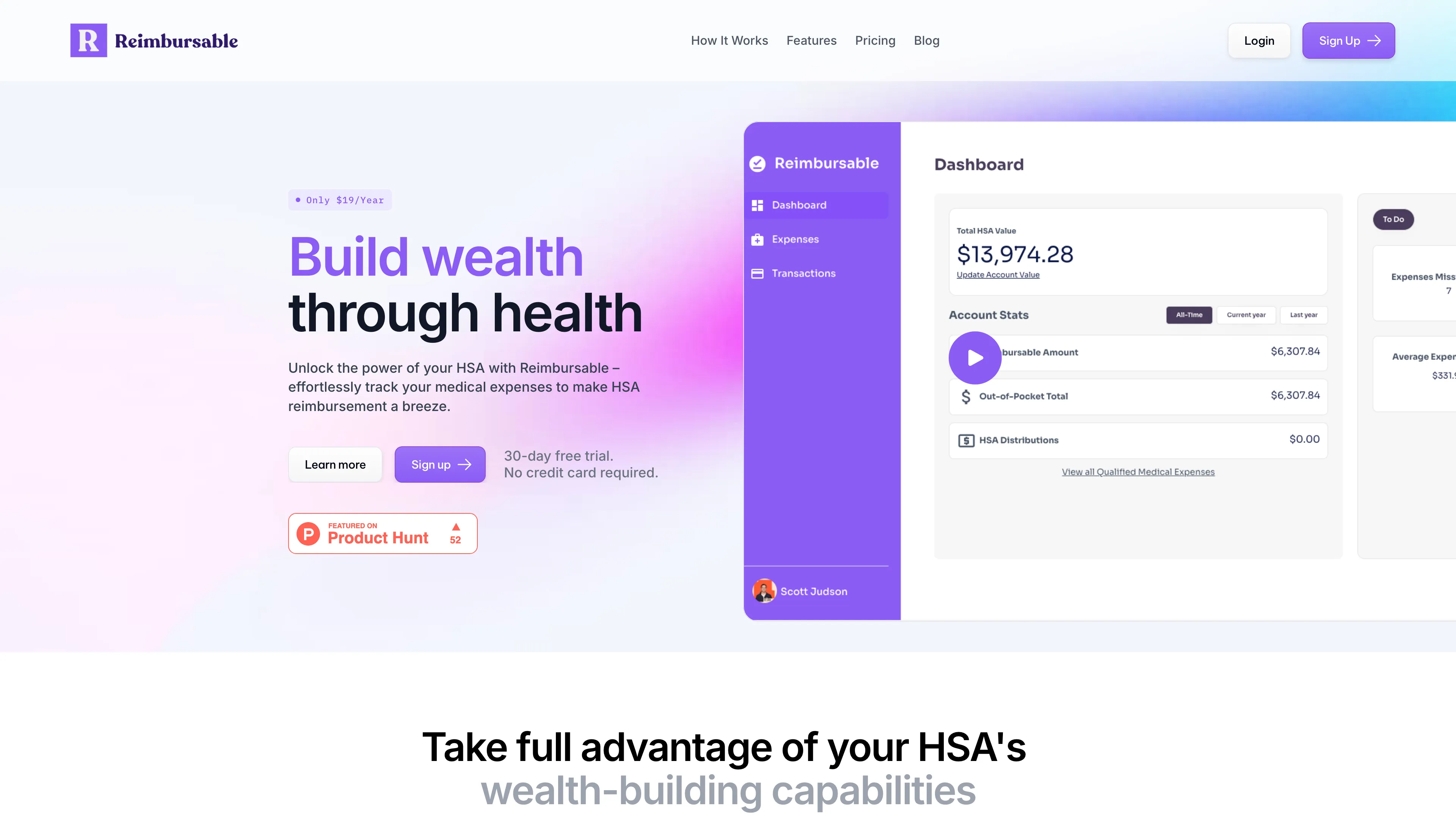

Reimbursable

Reimbursable makes HSA reimbursement easy by automatically tracking eligible medical expenses and securely storing receipts, helping you build wealth through health.

Reimbursable Introduction

Reimbursable is a nifty app designed to simplify the tedious task of tracking HSA-eligible medical expenses. By seamlessly integrating with bank accounts through Plaid, it auto-detects out-of-pocket expenses that qualify for reimbursement. Imagine no more manual entries or sifting through old receipts. All these expenses are stored securely, ensuring you're prepared for any future IRS audits. It's like having a virtual assistant for your medical finances. Priced at $19/year, it offers peace of mind and helps your HSA investments grow without hassle. Ideal for anyone looking to streamline their health expense tracking.

Reimbursable Key Features

Seamless Integration with Bank Accounts

Connect your HSA, credit, or checking accounts securely using Plaid. Automatically discover and track eligible out-of-pocket medical expenses, making bookkeeping a breeze.

Effortless Expense Tracking

Each qualified medical expense is logged and updated over time in Reimbursable. Compile tax forms and future distributions quickly and efficiently without manual tracking.

Permanent Receipt Storage

Store your medical receipts securely within Reimbursable. Access them anytime with ease, ensuring you're always prepared for tax time or an IRS audit.

Holistic Financial View

Get a comprehensive understanding of your HSA's value and how much is eligible for reimbursement. Make informed financial decisions with a full picture of your HSA health.

Affordable & Accessible

For only $19/year, start tracking your medical expenses and build wealth through health. Enjoy a 30-day free trial with no credit card required, making it easy to get started.

Reimbursable Use Cases

Family Healthcare Management: A mother of three uses Reimbursable to automatically detect and track qualified medical expenses through her connected credit and checking accounts. This makes managing the family’s healthcare costs seamless, ensuring all eligible expenses are documented and ready for future HSA reimbursements, thus alleviating the burden during tax time.

Young Professionals Building Wealth: A young professional, new to the workforce, uses Reimbursable to store receipts for medical expenses securely. With the ability to track all out-of-pocket expenses and keep them organized, the professional maximizes the HSA's tax-free growth, contributing to long-term wealth-building while having peace of mind in case of an IRS audit.

Simplifying Tax Preparation: During tax season, a freelancer integrates their bank account with Reimbursable. The platform auto-discovers all eligible medical expenses and compiles them into a comprehensive record. This feature simplifies the process of completing HSA tax forms and ensures accuracy, ultimately saving time and reducing stress.

Peace of Mind for Elderly Caregivers: A caregiver for elderly parents uses Reimbursable to keep track of numerous medical expenses. By securely storing all receipts and having an automatically updated record of out-of-pocket costs, the caregiver is well-prepared for future reimbursements, which helps manage the financial aspects of elderly care more effectively.

Financial Planning for Future Healthcare Needs: A graduate student planning for future healthcare needs links their HSA with Reimbursable. The automatic detection of eligible expenses allows them to build an accurate picture of reimbursable amounts over time. This planning helps in making informed financial decisions and ensuring efficient use of their HSA benefits.

Reimbursable User Guides

Step 1: Sign up and connect your HSA, credit, or checking account using Plaid for secure integration.

Step 2: Allow Reimbursable to auto-detect out-of-pocket medical expenses from your connected accounts.

Step 3: Add and categorize your medical expenses, updating records as needed for accurate tracking.

Step 4: Securely store receipts by uploading them to Reimbursable, ensuring they are available for future reference.

Step 5: At tax time, compile your expenses easily and generate necessary forms, like HSA tax form 8889.

Reimbursable Frequently Asked Questions

Reimbursable Website Analytics

Reimbursable Alternatives

Caffeine Log helps you monitor and manage your caffeine intake with ease, featuring rich beverage data, pattern analysis, and seamless device synchronization to support a healthier lifestyle.

Creem offers a seamless payment integration with transparent fees, featuring user-friendly components to boost revenue, plus 24/7 support for global business growth.

DokkoAI is a conversational AI platform that centralizes your data to enhance chatbots, provide quick customer support, and streamline processes with real-time, contextually relevant responses.

MoneyVision helps you visualize and track multiple financial goals with customizable widgets, all while keeping your data 100% private.

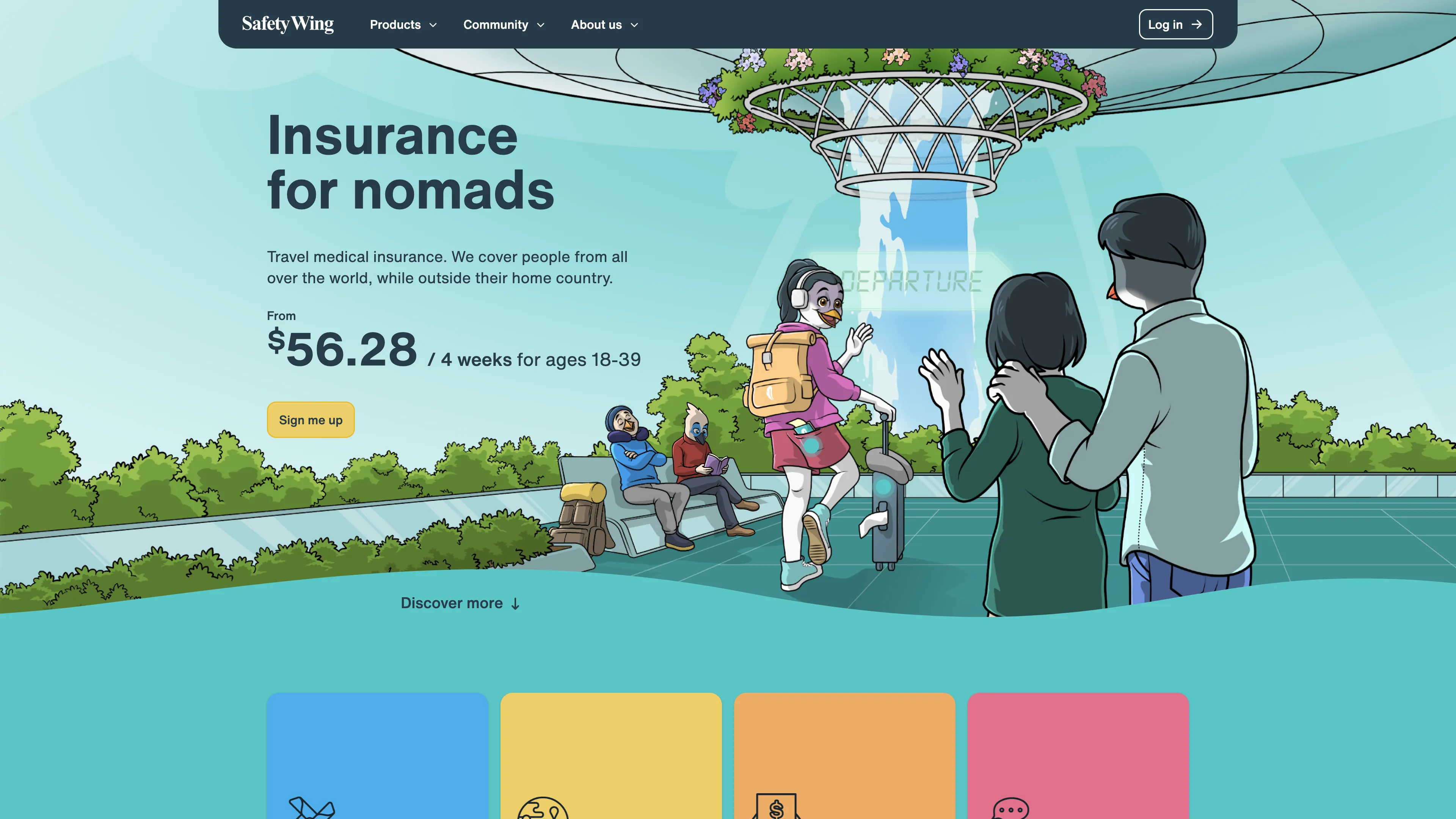

Nomad Insurance by SafetyWing offers comprehensive travel coverage for nomads, including medical treatment and evacuation, with a user-friendly policy customizer.

PolygrAI offers real-time emotion and deception analysis using AI to enhance risk assessment across various fields with over 70% accuracy.