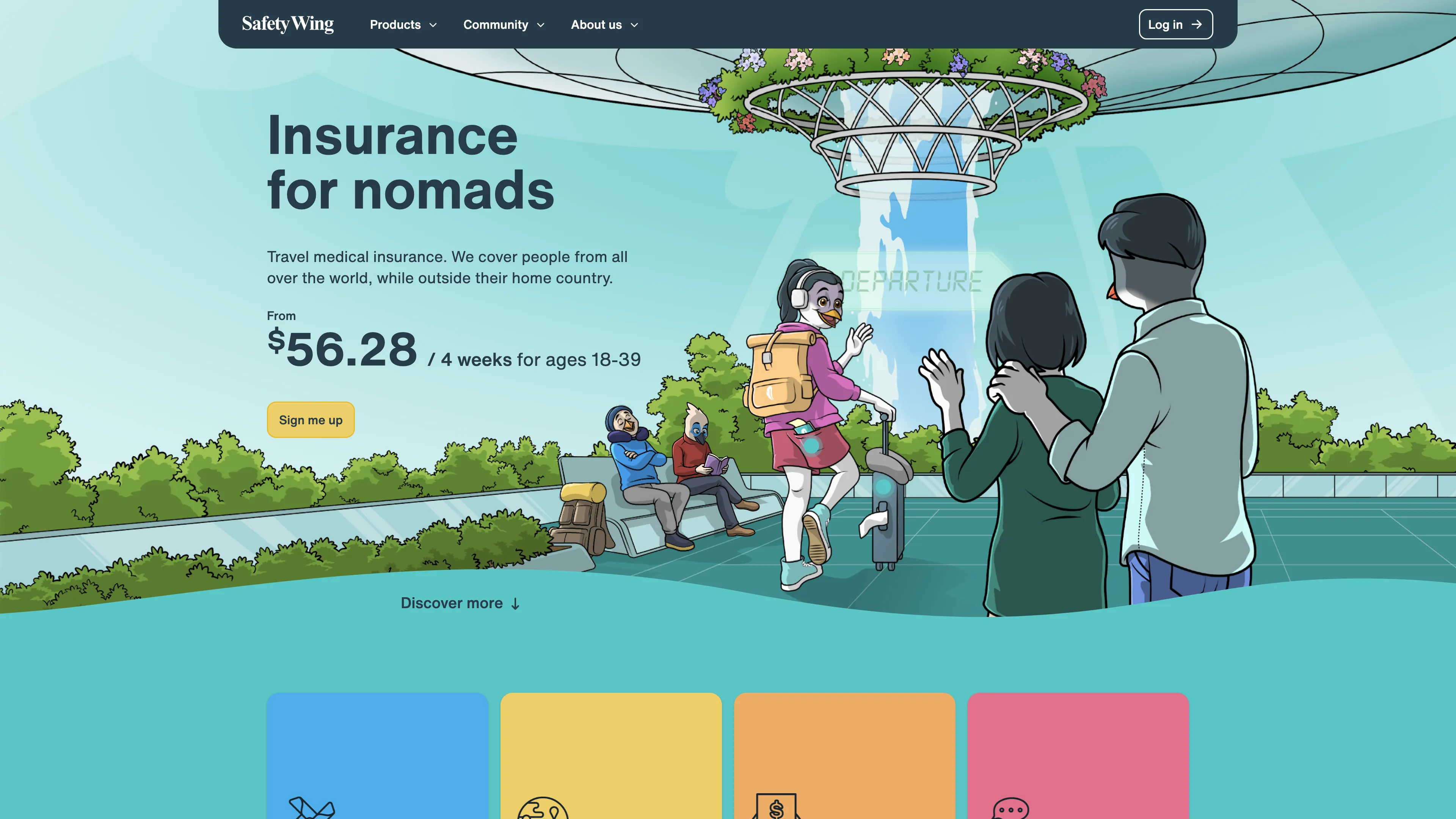

Nomad Insurance

Nomad Insurance by SafetyWing offers comprehensive travel coverage for nomads, including medical treatment and evacuation, with a user-friendly policy customizer.

Nomad Insurance Introduction

Nomad Insurance from SafetyWing offers digital nomads peace of mind with comprehensive travel coverage. It’s like having a safety net while exploring the world, covering unexpected events such as medical emergencies, leisure sports injuries, and travel delays. With a cap of $250,000 for various treatments and evacuations, it’s tailored for those who wander. For instance, if stuck abroad due to illness, this insurance provides access to doctors and hospitals without hassle. Imagine it as a dependable travel companion, ensuring that the only surprises on your trip are pleasant adventures, not unexpected expenses.

Nomad Insurance Key Features

Extensive Medical Coverage

Offers medical treatment abroad like hospital stays, ambulance rides, and prescription medications, addressing the common worries of international travelers needing unexpected healthcare.

Evacuation Assistance

Provides up to $100,000 for evacuation to better equipped hospitals. Imagine an unfortunate accident on a remote hiking trail and knowing there's support to get you to the best care.

Coverage for Leisure Sports

Covers injuries from various leisure sports with a substantial $250,000 limit, perfect for adventurous nomads indulging in skiing or canoeing without the anxiety of hefty medical costs.

Home Return Benefits

Includes coverage for flights home due to family emergencies up to $5,000. This is reassuring for travelers yearning for support when unexpected situations demand a return home.

Travel Delay Compensation

Compensates up to $100 per day for travel delays over 12 hours, easing the burden of unforeseen disruptions like weather delays or missed connections with financial support.

Nomad Insurance Use Cases

Adventure Travel Safety: Nomads exploring the wilderness can rely on Nomad Insurance's coverage for injuries from leisure sports, such as hiking or canoeing, ensuring peace of mind in remote locations.

Emergency Medical Assistance Abroad: Travelers experiencing sudden illness or injury can access any hospital, with costs covered up to $250,000, providing crucial support when far from home.

Travel Delay Support: In case of journey interruptions over 12 hours, Nomad Insurance offers meals and accommodations, turning setbacks into manageable inconveniences.

Family Emergency Travel: If a family crisis arises, the policy covers flights home, allowing nomads to swiftly reconnect without financial strain.

Personal Accident Coverage: For licensed drivers involved in motor accidents, the product offers substantial medical and evacuation coverage, enhancing travel confidence.

Nomad Insurance User Guides

Step 1: Visit the SafetyWing website to access the Nomad Insurance section.

Step 2: Use the pricing calculator to customize your policy based on your age and needs.

Step 3: Review the full policy for details on what is and isn't covered.

Step 4: Purchase your policy by selecting specific coverage dates and paying in full.

Step 5: In case of medical need abroad, visit any doctor or hospital for treatment.

Nomad Insurance Frequently Asked Questions

Nomad Insurance Website Analytics

- United States32.6%

- United Kingdom6.0%

- Germany4.9%

- Canada3.9%

- Brazil3.7%

Nomad Insurance Alternatives

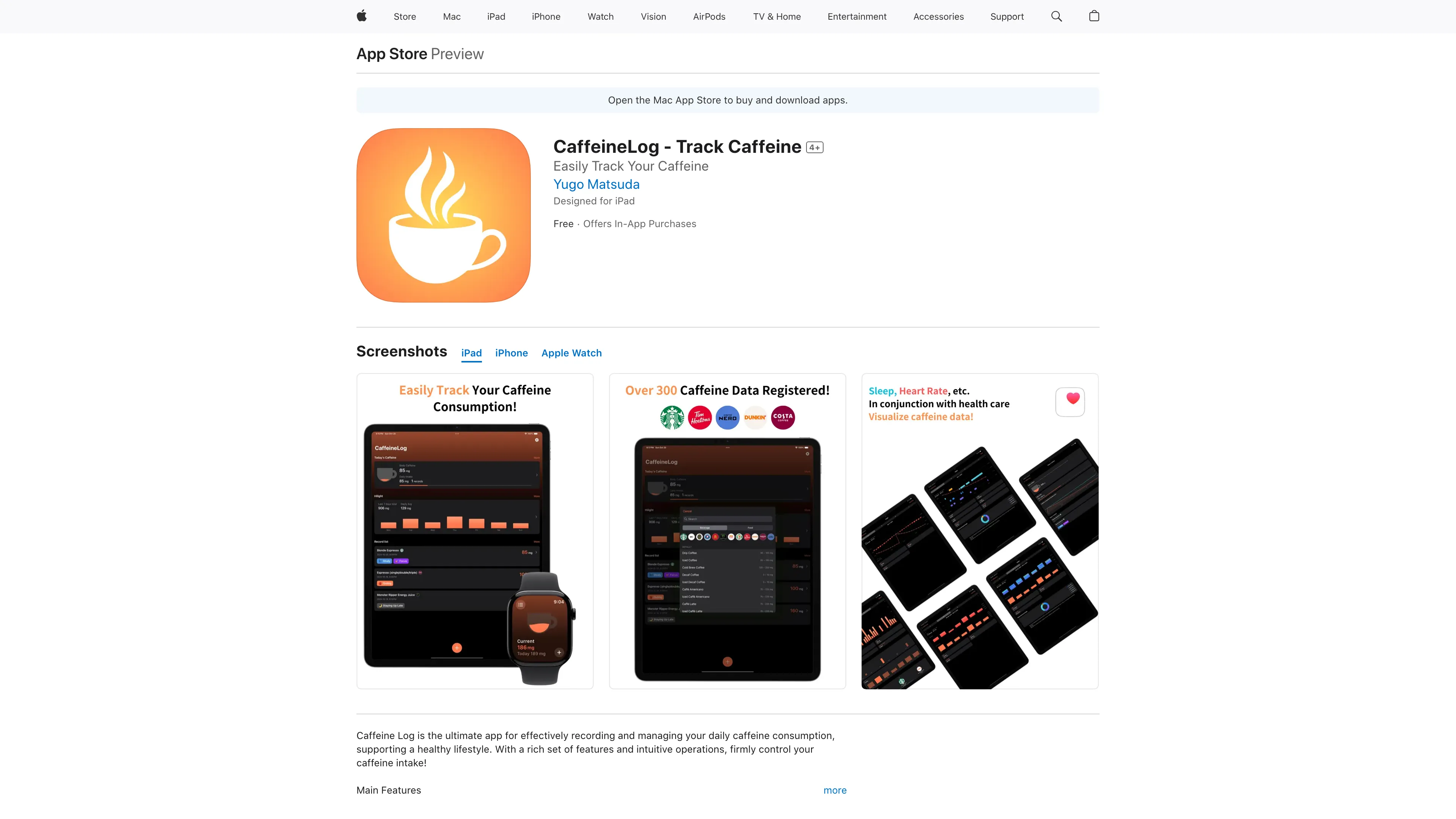

Caffeine Log helps you monitor and manage your caffeine intake with ease, featuring rich beverage data, pattern analysis, and seamless device synchronization to support a healthier lifestyle.

DokkoAI is a conversational AI platform that centralizes your data to enhance chatbots, provide quick customer support, and streamline processes with real-time, contextually relevant responses.

PolygrAI offers real-time emotion and deception analysis using AI to enhance risk assessment across various fields with over 70% accuracy.

PregnantMeal offers personalized meal plans for pregnant women, ensuring nutritious, stress-free eating tailored to each trimester with tasty recipes.

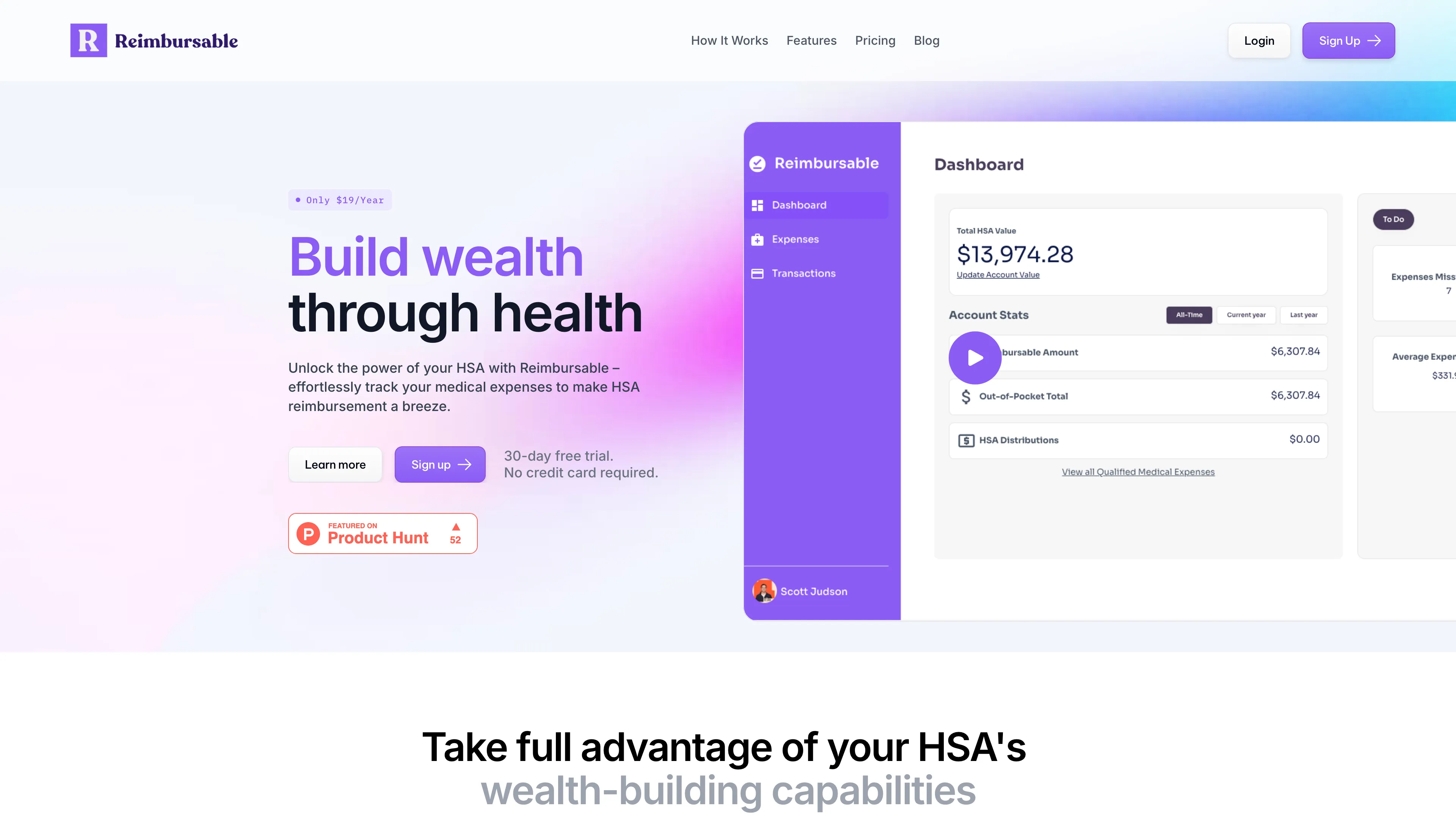

Reimbursable makes HSA reimbursement easy by automatically tracking eligible medical expenses and securely storing receipts, helping you build wealth through health.