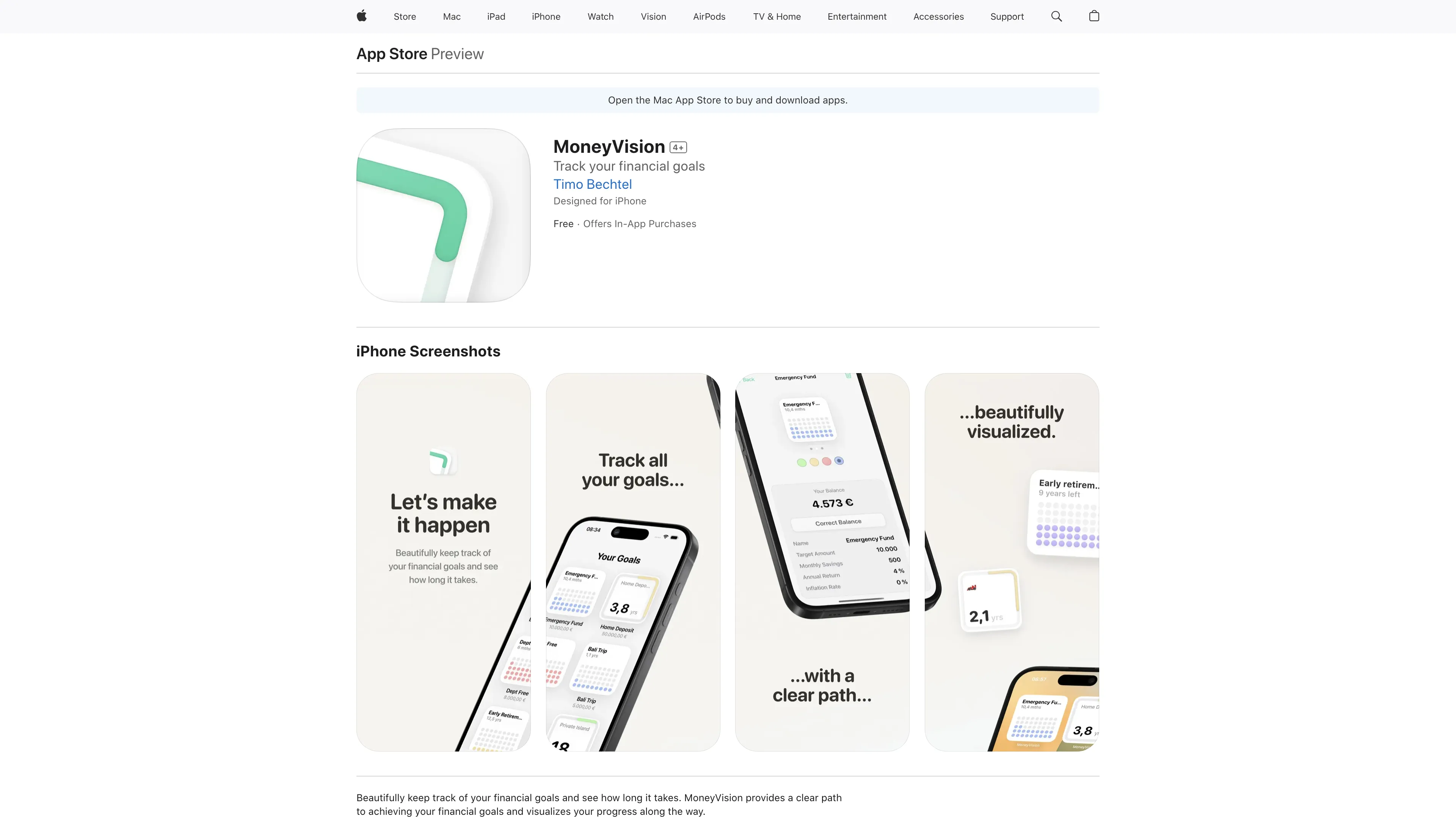

MoneyVision

MoneyVision helps you visualize and track multiple financial goals with customizable widgets, all while keeping your data 100% private.

MoneyVision Introduction

MoneyVision is a handy iOS app designed to help visualize and track financial goals on your home screen. With customizable widgets, users can monitor multiple goals simultaneously, seeing real-time progress and time-to-goal estimates. By inputting factors like monthly savings, inflation, and annual returns, the app calculates how long it will take to achieve those goals. This visual reminder can be a significant motivational boost, making financial objectives seem more attainable. Plus, all data is kept private, staying securely on your device. The free version offers one goal and widget style, while the Pro upgrade provides unlimited goals and styles, along with future premium features.

MoneyVision Key Features

Customizable Widgets for Your Financial Goals

MoneyVision lets users place beautiful, adjustable widgets directly on their home screens, putting financial goals front and center. This makes it super easy to stay motivated and keep savings goals in sight every day.

Track Multiple Goals Simultaneously

Managing various financial aspirations is a breeze with the ability to track multiple goals at once. Whether saving for a new car, a vacation, or an emergency fund, MoneyVision ensures all goals are monitored in real-time.

Real-Time Progress Updates and Time Estimates

With real-time updates, users can instantly see how their savings are progressing and get estimates on how long it will take to reach their goals. This immediate feedback is like having a personal financial coach right on your phone.

Privacy First, 100% Offline

All data remains secure on the user’s device, ensuring complete privacy. No internet connection is needed, and there are no ads or tracking, making it a trustworthy tool for managing finances privately.

Adjustable for Inflation, Annual Returns, and Monthly Savings

MoneyVision provides a realistic financial outlook by allowing adjustments for factors like inflation, annual returns, and monthly contributions. By visualizing these variables, users can make informed decisions and better plan for the future.

MoneyVision Use Cases

Morning Motivation: Every morning, Sarah checks her home screen to see her progress towards her vacation fund. The customizable widget displays real-time updates, reminding her that small, consistent savings bring her beach dreams closer. This daily visual nudge helps her stay motivated and focused.

Multiple Goals Management: John, a recent graduate, is juggling saving for a car, an emergency fund, and student loan repayment. MoneyVision supports multiple goals, allowing him to see all his financial targets at a glance. This consolidated view simplifies his budgeting and keeps him on track for each goal.

Private and Secure Budgeting: Emma is concerned about privacy when it comes to her financial information. MoneyVision keeps all data on her device and requires no internet connection, ensuring her peace of mind. She can focus on achieving her financial goals without worrying about data breaches or ads.

Inflation and Returns Adjustment: Alex is planning for long-term goals like a house down payment. He uses MoneyVision's features to adjust for inflation and annual returns, giving him a realistic estimate of when he can afford his dream home. This helps him make informed decisions about his monthly contributions and investment strategies.

Motivational Notifications: Linda often loses sight of her savings goals amidst her busy schedule. With MoneyVision's upcoming feature of motivational notifications, she will receive inspiring updates about her progress. These timely reminders keep her engaged and on track, making her financial journey more interactive and rewarding.

MoneyVision User Guides

Step 1: Download and install MoneyVision from the App Store on your iOS device.

Step 2: Open the app and set up your first financial goal by entering the amount needed, monthly savings, and any inflation or return rates.

Step 3: Add a customizable widget to your home screen to display your goal's progress and time-to-goal estimate.

Step 4: Track multiple goals simultaneously by setting them up within the app, each with its own widget.

Step 5: Monitor your real-time progress with on-device data, ensuring your privacy and maintaining motivational insight.

MoneyVision Frequently Asked Questions

MoneyVision Website Analytics

MoneyVision Alternatives

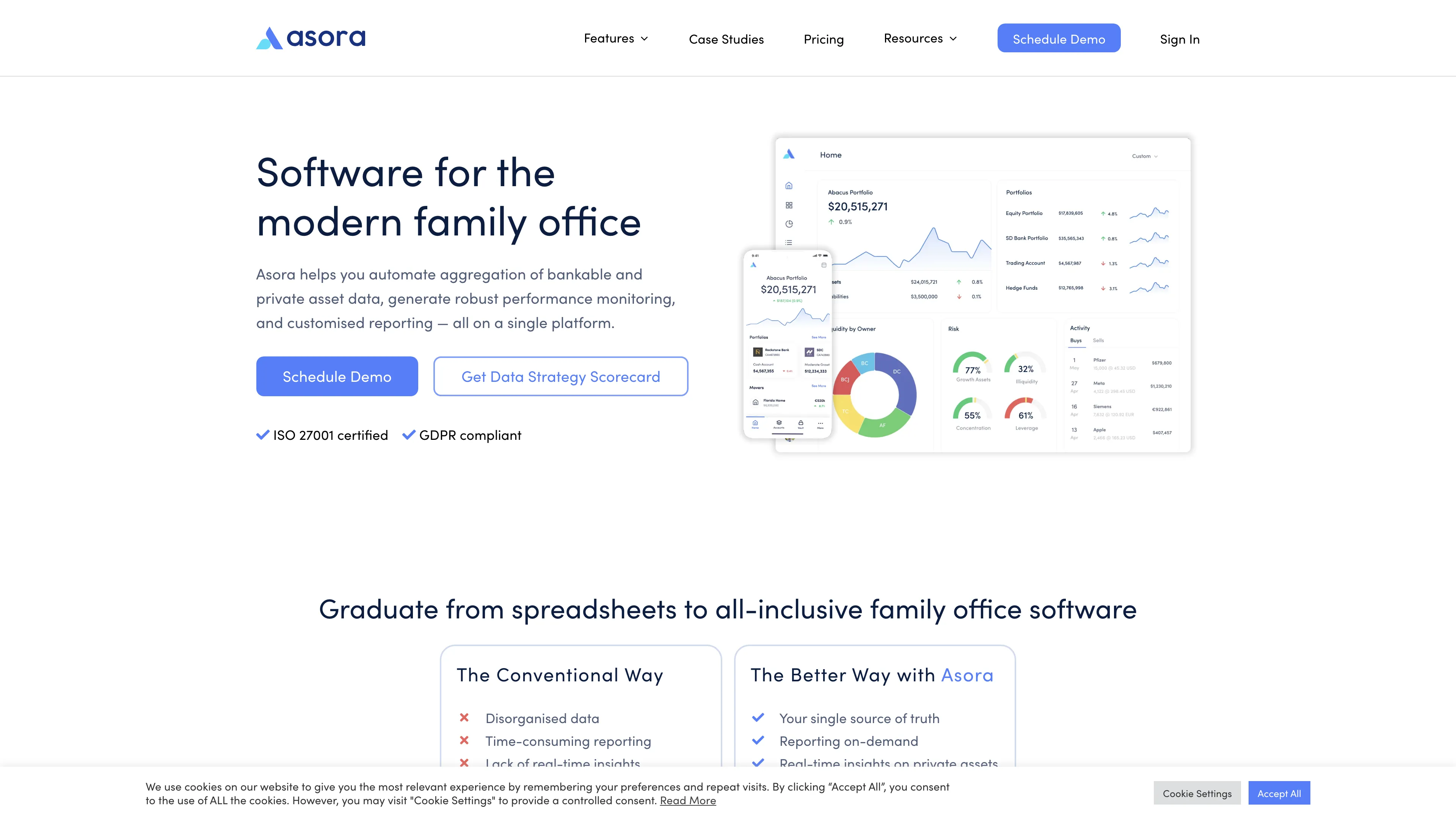

Asora is a SaaS platform simplifying family office operations by automating asset tracking and providing on-demand, customized performance reports.

Breathhh offers automated mindful practices while browsing, reducing anxiety and stress without forming habits, free with customizable settings.

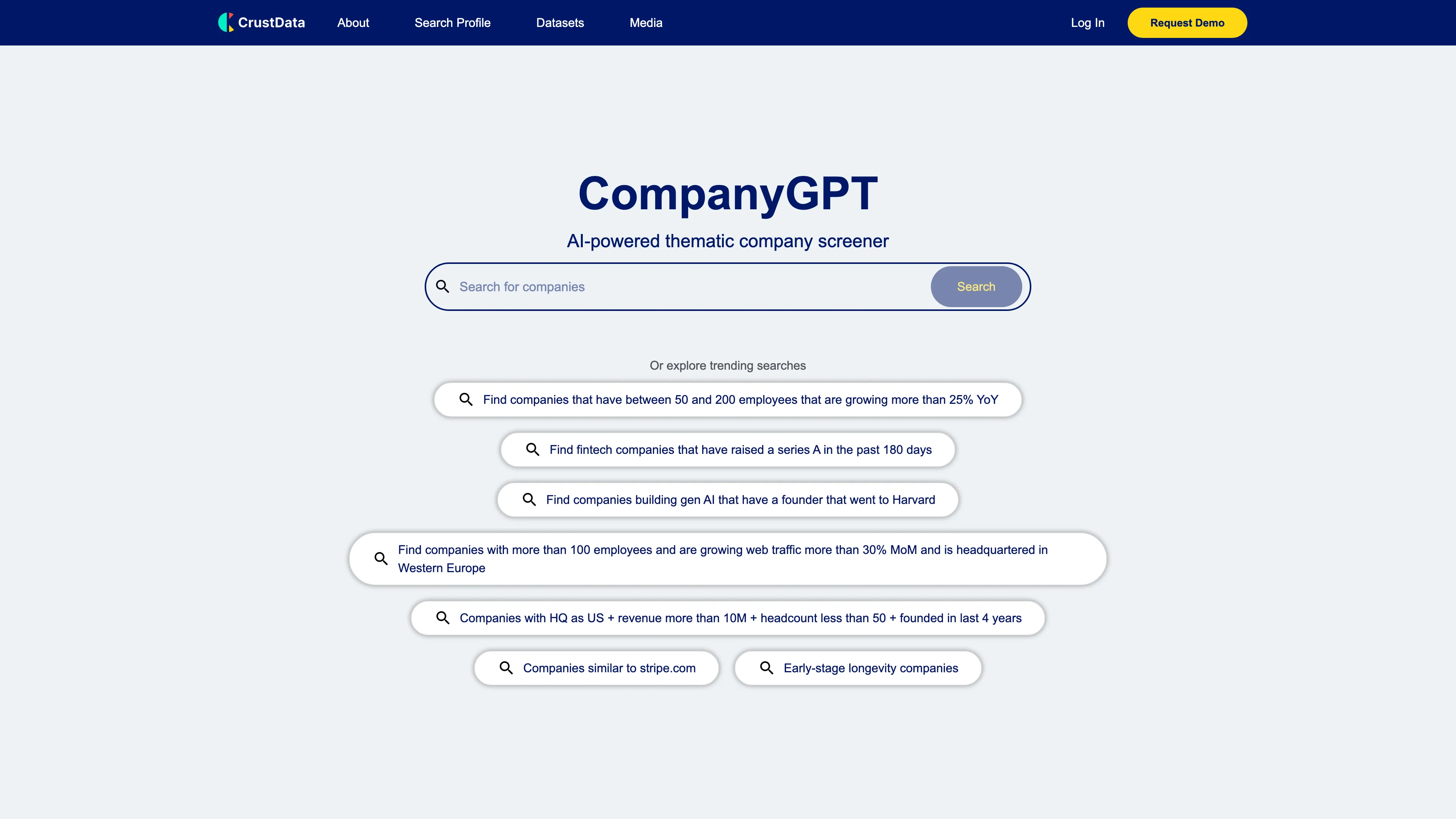

CompanyGPT helps identify high-growth companies by specific criteria like size, location, and growth metrics, offering detailed insights into trending businesses.

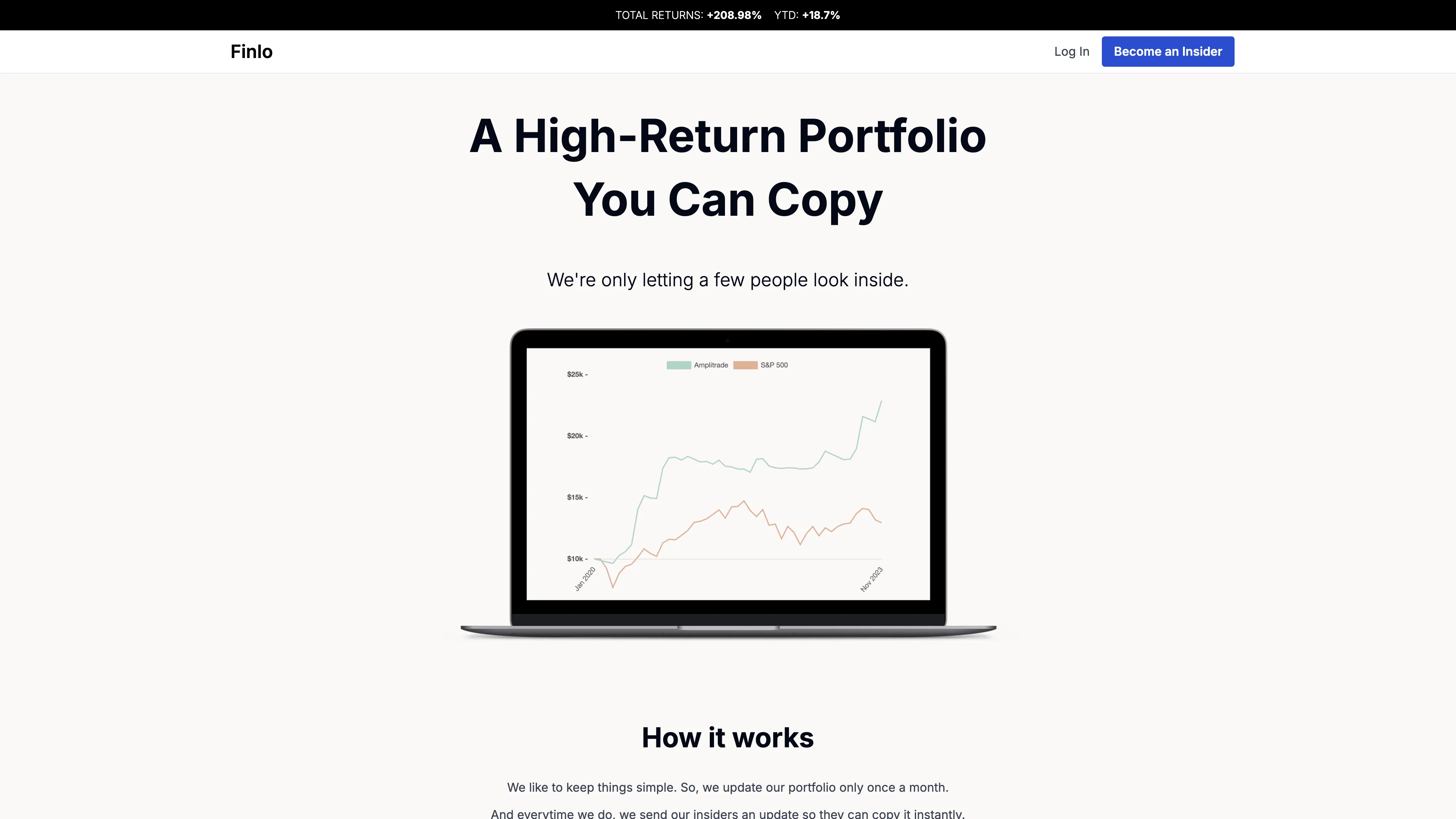

Finlo offers a high-performance, algorithm-driven stock portfolio that outperforms the S&P 500, allowing easy monthly updates with no emotional bias or need for direct money handling.

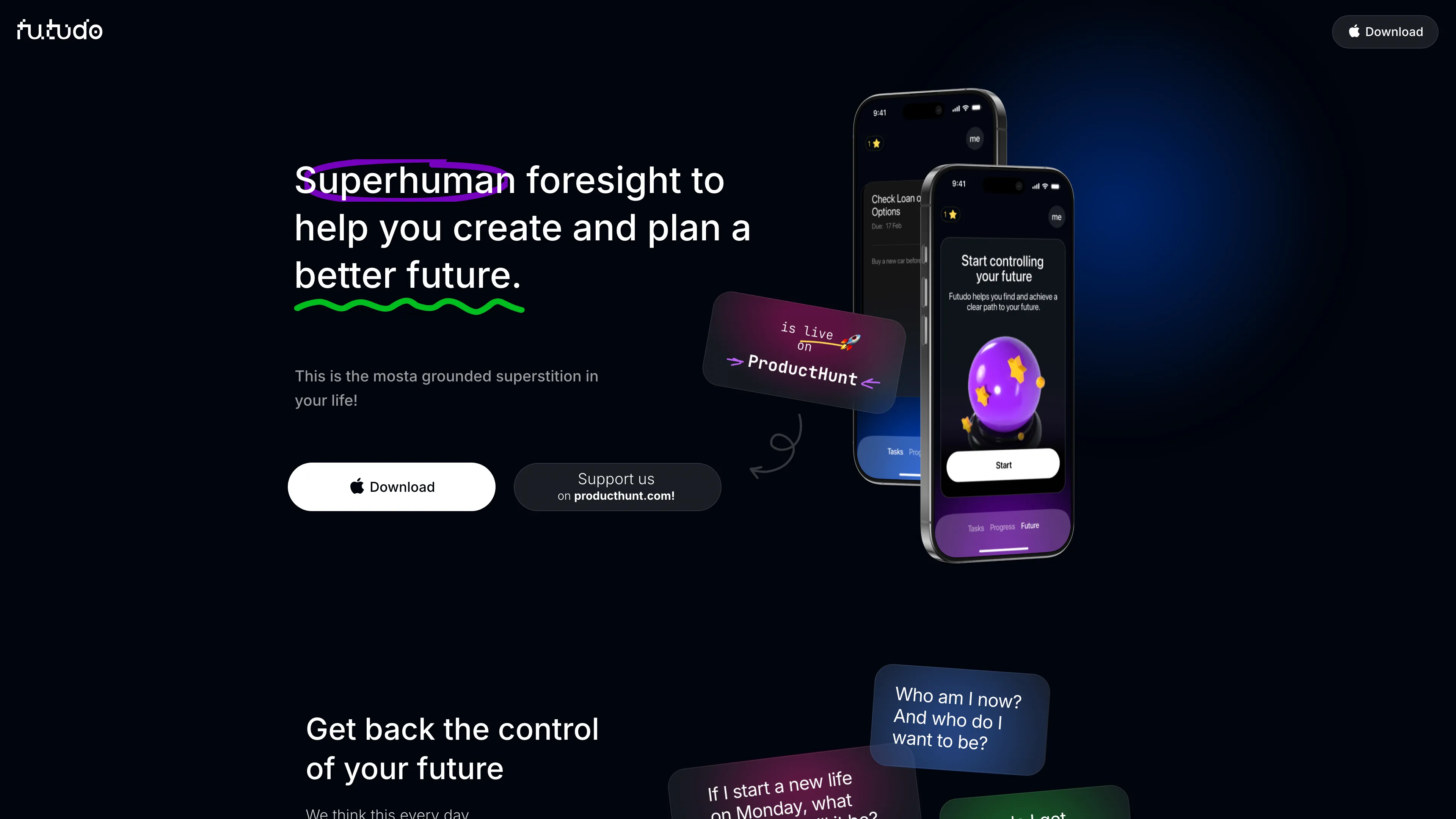

Futudo AI helps you connect your past to your future by analyzing personal trends and recommending actions, enabling you to make informed decisions and achieve your life goals.

Clearspace helps you reduce digital distractions by setting time limits on app usage, ensuring focused and intentional screen time management.