Asora

Asora is a SaaS platform simplifying family office operations by automating asset tracking and providing on-demand, customized performance reports.

Asora Introduction

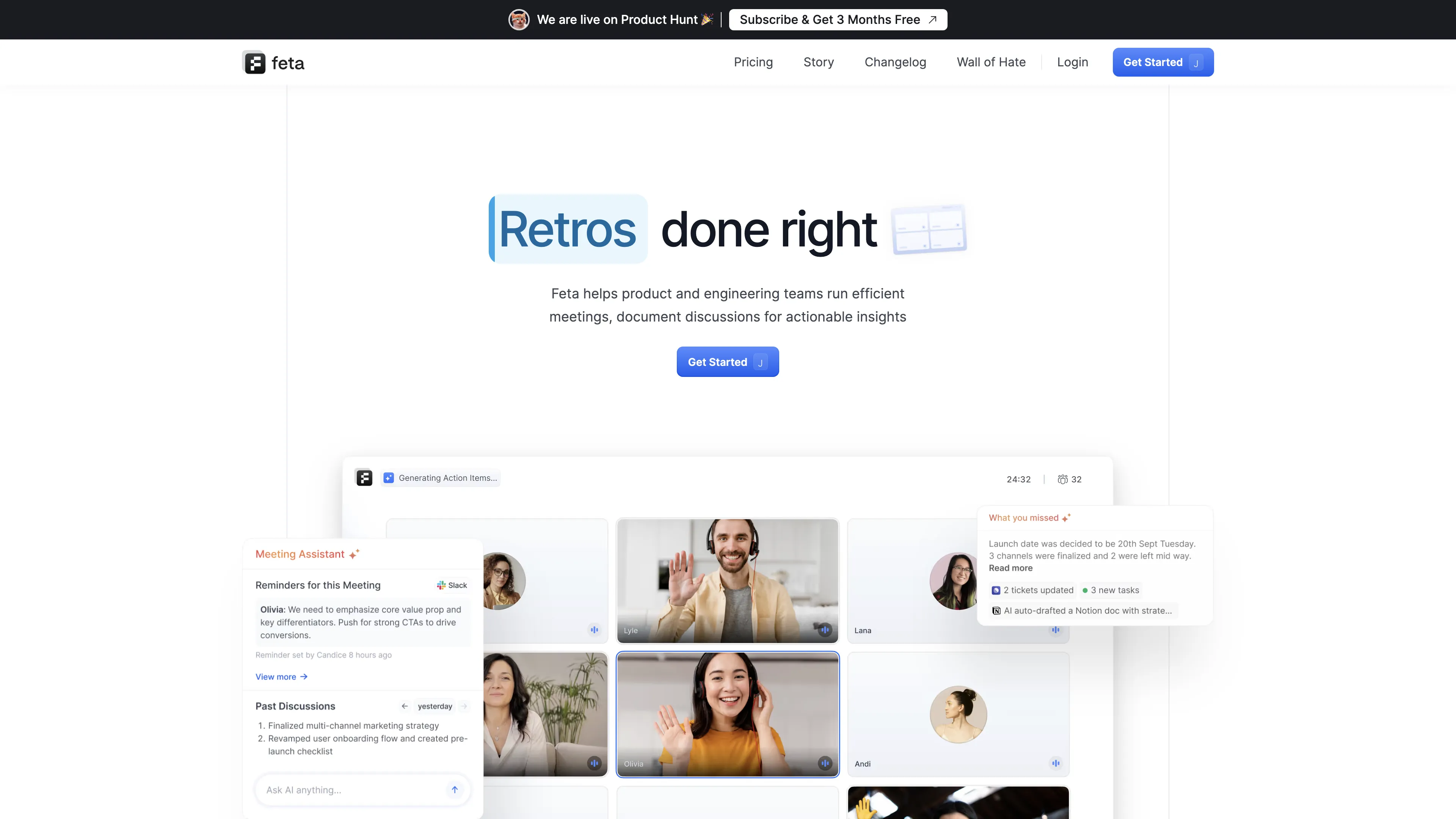

Asora is a modern SaaS solution for family offices designed to streamline asset management and data aggregation. It replaces the chaos of multiple logins and spreadsheets with a centralized platform that connects bank and investment accounts, tracks both liquid and private assets, and generates customized performance reports. Imagine having all your financial details neatly organized and accessible in real-time, much like having a personal assistant for your finances. With features like data automation, secure document storage, and workflow alerts, Asora ensures you have a single source of truth for every asset and transaction. Its mobile access feature means staying updated on the go is effortless, promoting efficient and proactive financial management without the headaches of traditional reporting. This makes Asora an invaluable tool for those managing complex family wealth structures.

Asora Key Features

Data Automation

Connects bank and investment accounts to a single secure platform, eliminating the need to log into multiple portals and consolidating finances into one easily manageable dashboard.

Performance Monitoring

Allows creation of customized performance reports with real-time metrics like IRR and time-weighted returns, making financial analysis as effortless as a few clicks.

Private Assets Tracking

Handles tracking of diverse assets including properties, private equity, and collectibles within complex entity structures, offering a comprehensive view of overall wealth.

Centralized Document Vault

Simplifies document management by linking documents directly to associated assets and accounts, tagged for easy retrieval, and securely shareable within the platform.

Mobile Access

Provides on-the-go access to real-time portfolio performance, essential documents, and net worth, ensuring users stay updated no matter where they are, with the extra security of 2FA.

Asora Use Cases

Efficient Financial Reporting for CEOs:A busy CEO uses Asora's Performance Monitoring feature to create customized performance reports on-demand, saving hours previously spent on Excel and providing real-time insights to make informed decisions quickly.

Seamless Asset Management for Wealthy Families:A wealthy family tracks their diverse assets like properties and collectibles with Asora’s Private Assets feature, transforming data disorganization into a single source of truth, simplifying complex entity structures, and enhancing asset visibility.

On-The-Go Investment Tracking for Financial Advisors:A financial advisor accesses Asora’s Mobile feature while traveling, staying updated with real-time portfolio performance and market insights, effectively advising clients without being tied to the office.

Enhanced Document Security for Trust Companies:A trust company utilizes Asora's secure Documents feature to manage and securely share essential documents linked to various assets and accounts, ensuring comprehensive tracking and compliance with ease.

Automated Data Integration for Family Offices:A family office connects numerous bank and investment accounts through Asora's Data Automation feature, eliminating the hassle of multiple logins and creating a centralized, secure platform for effortless data management.

Asora User Guides

Step 1: Connect your bank and investment accounts to Asora for centralized asset tracking.

Step 2: Set up custom asset categories, including properties and private equities, to keep everything organized.

Step 3: Use the Performance Monitoring feature to create dynamic, customized performance reports.

Step 4: Upload important documents to Asora’s secure document vault for easy access and management.

Step 5: Enable mobile access for real-time updates and control your assets on the go.

Asora Frequently Asked Questions

Asora Website Analytics

- United States49.7%

- Ireland26.2%

- France12.3%

- Israel7.6%

- India4.2%

Asora Alternatives

PineAI's assistant handles bill negotiations, customer support calls, and subscription cancellations, saving you time and reducing costs by using AI-powered strategies.

Effortlessly create interactive data visualizations with CalcGen AI, using your data or letting the AI gather it — no data cleaning required!

CompanyGPT helps identify high-growth companies by specific criteria like size, location, and growth metrics, offering detailed insights into trending businesses.

Contacted.io leverages AI to deliver detailed SEO and content reports, optimizing website visibility and engagement with easy-to-follow, platform-specific guidance.

Feta streamlines stand-ups, retros, and syncs for product and engineering teams with AI-powered documentation and automated workflows.