Finlo

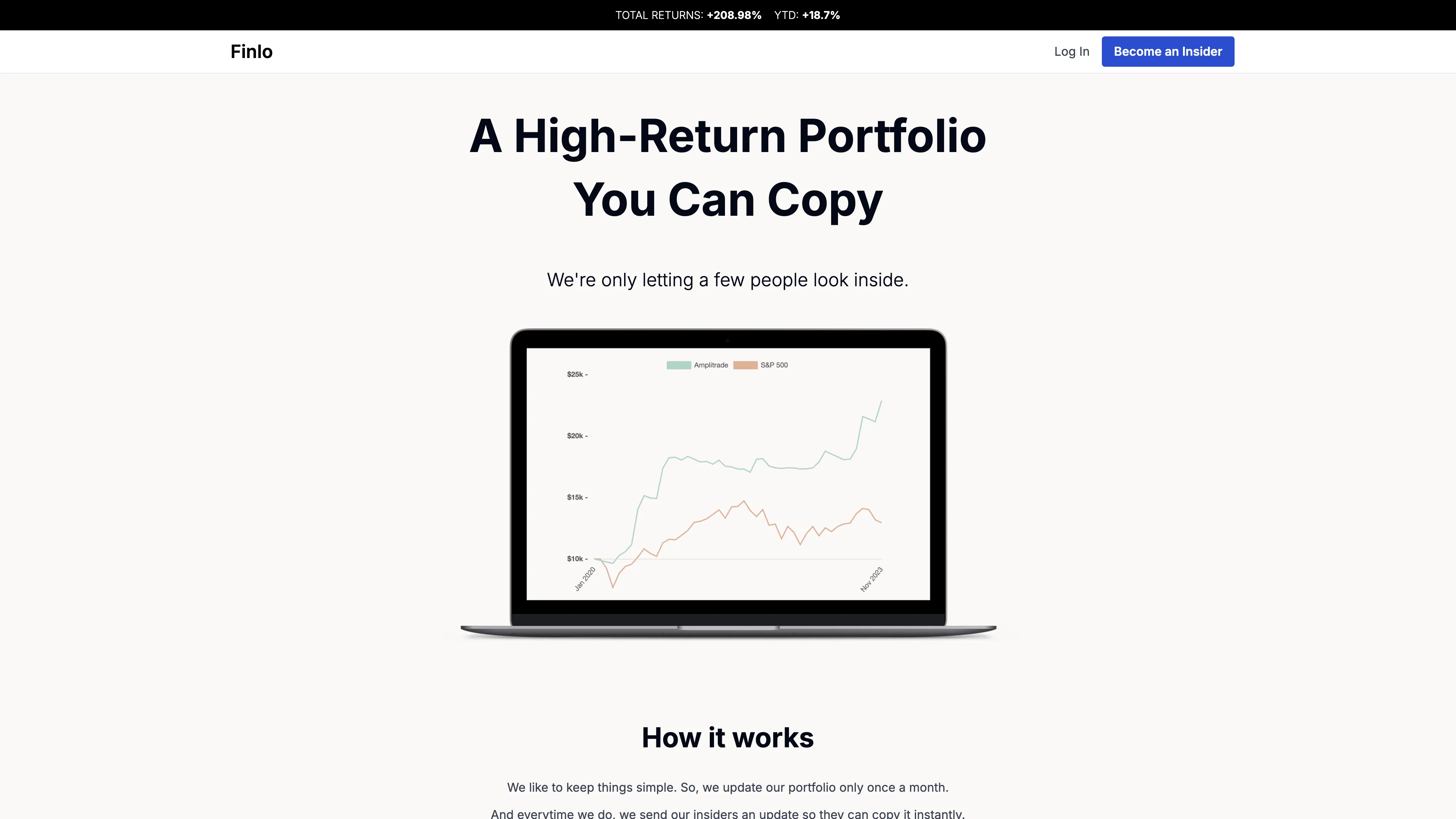

Finlo offers a high-performance, algorithm-driven stock portfolio that outperforms the S&P 500, allowing easy monthly updates with no emotional bias or need for direct money handling.

Finlo Introduction

Finlo offers a unique AI-driven stock portfolio that outperforms the S&P 500 index, boasting an impressive CAGR of over 27% since 2016. This portfolio, updated monthly, consists of just six stocks and is easy to mimic using your own broker, eliminating the need for Finlo to handle your funds. It's akin to having a personal hedge fund, designed with Modern Portfolio Theory to diversify and minimize risks effectively. By using a quantitative algorithm devoid of emotional bias, Finlo provides a clear and straightforward approach to investing. Whether an experienced investor or just starting out, the service allows access to high-tier financial strategies with simplicity and ease.

Finlo Key Features

High Performance Portfolio

Offers returns surpassing the S&P 500 with a CAGR of over 27% since 2016, making it a compelling choice for those seeking higher growth with minimized risk.

Easy Portfolio Copying

Enables users to replicate its 6-stock portfolio in minutes each month, leveraging your own broker while ensuring complete control over your investment decisions.

Algorithmic Management

Operates using a quantitative directional strategy, eliminating emotional biases and guesswork, similar to having automated financial expertise at your fingertips.

Low-Cost Access to Expertise

With an annual fee of $99, it provides affordable access to a hedge fund-like strategy, revolutionizing the way individual investors enhance their portfolios.

Risk-Free Trial

Offers a 30-day money-back guarantee, allowing users to explore the platform's benefits without financial commitment, ensuring peace of mind.

Finlo Use Cases

Portfolio Optimization for Time-Pressed Investors: Busy professionals can replicate high-performing portfolios with minimal effort using Finlo's monthly updates, achieving superior returns without constantly monitoring the market.

Effortless Risk Management for New Investors: Novices can utilize Finlo's algorithmic management to diversify their investments across uncorrelated assets, minimizing risk while learning the ropes of stock investing.

Strategic Planning for Retirement Funds: Retirees use Finlo's hedge fund-like strategies to enhance growth in their portfolios, benefiting from a 27% CAGR since 2016, which outpaces traditional retirement plans.

Removing Emotional Bias from Trading Decisions: Finlo's technical analysis-based approach helps traders eliminate emotional decision-making, ensuring consistent, rational trades that align with market trends.

Cost-Effective Access to Advanced Investment Strategies: Budget-conscious investors gain access to sophisticated portfolio management for just $99 a year, allowing them to leverage high-end financial strategies without breaking the bank.

Finlo User Guides

Step 1: Sign up on Finlo's website to become an insider and access the monthly portfolio updates.

Step 2: On the first trading day of the month, check the list of 6 stocks shared with insiders.

Step 3: Use your own broker to place buy or sell orders according to Finlo's portfolio list.

Step 4: Allocate between 5% and 50% of your assets to potentially improve returns and lower risk.

Step 5: Review the portfolio changes each month; no need for constant monitoring or emotional decisions.

Finlo Frequently Asked Questions

Finlo Website Analytics

- United States33.0%

- Norway18.4%

- Canada6.3%

- United Kingdom5.4%

- Sweden3.7%

Finlo Alternatives

PineAI's assistant handles bill negotiations, customer support calls, and subscription cancellations, saving you time and reducing costs by using AI-powered strategies.

Asora is a SaaS platform simplifying family office operations by automating asset tracking and providing on-demand, customized performance reports.

Effortlessly create interactive data visualizations with CalcGen AI, using your data or letting the AI gather it — no data cleaning required!

CompanyGPT helps identify high-growth companies by specific criteria like size, location, and growth metrics, offering detailed insights into trending businesses.

Contacted.io leverages AI to deliver detailed SEO and content reports, optimizing website visibility and engagement with easy-to-follow, platform-specific guidance.